Now is Europe’s moment to rebuild its competitive edge

At a time when the global industrial landscape is shifting faster than at any point in recent history, Europe stands at a pivotal crossroads. Pressures from geopolitical volatility, technological disruption, climate urgency and a rapidly changing labour market are mounting – and the future prosperity of European manufacturing is in the balance.

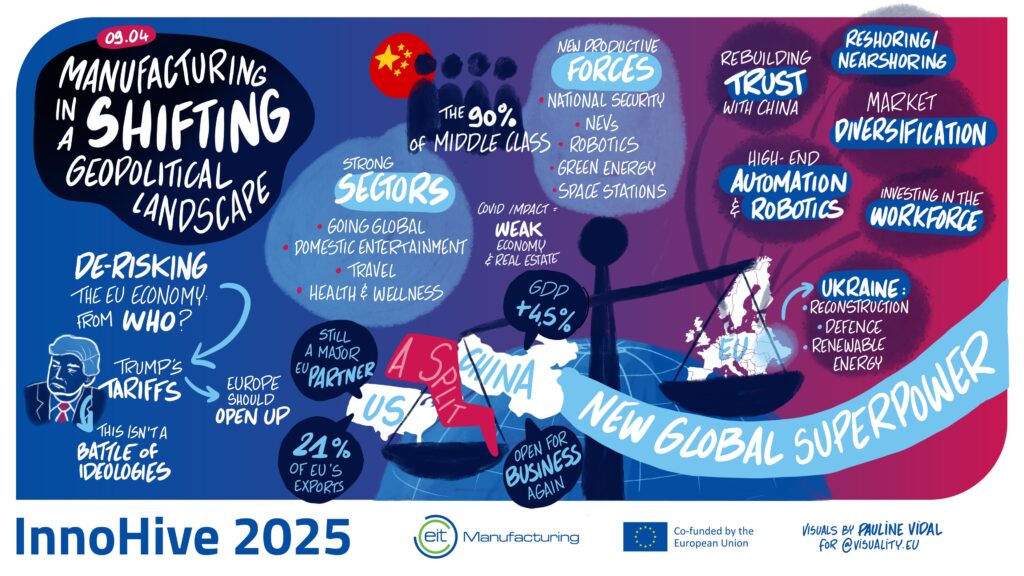

At InnoHive 2025, industry leaders and innovators engaged in several unflinching discussions about where Europe stands, where it is falling short and, most importantly, what it must do next. And a clear consensus emerged: Europe’s manufacturing comeback is possible, but only through decisive, collective action.

Visuals by Pauline Vidal

The challenges

Europe’s manufacturing sector, once the engine of its prosperity and social cohesion, now faces dual threats: external competition and a sluggish response to emerging challenges.

Despite a rich tradition of technical excellence, it has struggled to convert research leadership into industrial dominance. Without manufacturing competitiveness, Europe risks losing not just economic power, but also the foundations of its social model.

As Caroline Viarouge, CEO of EIT Manufacturing, pointed out: “Europe accounts for 17% of global patents, but only one-third get converted into market innovation.” Consensus soon formed that this problem isn’t a lack of ideas; it’s a failure of integration, the fragmentation of markets and a regulatory environment that stifles growth at scale. Startups and small and medium-sized enterprises (SMEs) often struggle to move across borders or access capital, undermining Europe’s capacity to turn invention into growth.

Meanwhile, Europe’s admirable prioritisation of sustainability has come with economic costs: higher energy prices, complex regulations and slower project approvals. As Željko Pazin, Executive Director of EFFRA, warned, overambitious sustainability must not become Europe’s economic Achilles’ heel – “we need competitive industry to fund healthcare, education – all the pillars of our society.”

Moderator Karin Helmstaedt, Kai Peters (VDMA), Zeljko Pazin, Caroline Viarouge at InnoHive 2025. Photo credit (c) Xavier Lejeune

Geopolitical volatility

A major thread running through many of the discussions at InnoHive 2025 was Europe’s growing vulnerability in a volatile world. Tariffs, shifting alliances and supply chain disruptions are exposing Europe’s dependency on single suppliers and fragile trade links. Pazin was blunt: “Diversification is no longer optional. It’s strategic.”

While Europe remains heavily tied to US markets, many urged the need to rebalance the European economy towards emerging economies – those in Africa, Latin America and Asia. The days of relying on familiar partners are over; future resilience will come from new, broader partnerships.

Supply chains were another key consensus. Europe’s economic model, long reliant on global openness and stable trade flows, is now under direct threat from rising tariffs, supply chain shocks and the strategic industrial policies of major powers like the US and China. Dependencies once considered manageable, for semiconductors, rare earths and energy, for example, have become visible points of vulnerability.

In a world where control over technology and resources increasingly defines power, Europe’s ability to secure its industrial base will be central to maintaining its autonomy and way of life.

Yet vulnerability also opens new opportunities. As Shaun Rein, Founder and Managing Director at China Market Research Group, pointed out, while the US flips between its strategic goals and domestic politics, China remains “heads-down, building.” Europe, in contrast, has the chance to carve out a distinct third path – one based on sustainability, high-quality production and democratic values.

Anastasiia Vereshchynska, Director at the European-Ukrainian Energy Agency, described Ukraine’s rapid, market-driven reconstruction efforts, which offered a glimpse of what agile, resilient rebuilding can look like even in the harshest conditions. Vereshchynska highlighted: “Ukraine’s business-led reconstruction, launched in the midst of war, shows what resilient, opportunity-driven rebuilding can look like – even under constant threat. It’s not donations that build a stable economy, but investment, adaptation and strategic collaboration.”

Anastasiia Vereschchynska, Director at the European-Ukrainian Energy Agency, at InnoHive 2025. Photo credit (c) Xavier Lejeune

As Pazin put it: “We need to build new bridges – reliable, long-term partnerships that don’t hinge on any one geopolitical relationship.” Instead, Europe must diversify its trade partnerships, invest strategically in emerging regions and turn resilience into a competitive advantage.

Rein underlined the need for long-term thinking amid global volatility: “Business will continue, regardless of politics. The key is to think long-term and build where others are distracted.” That will require clear priorities, as Viarouge reminded delegates: “Europe can’t do everything. We must prioritise sectors and technologies.”

Europe can’t do everything. We must prioritise sectors and technologies.

Caroline Viarouge, CEO of EIT Manufacturing

AI and digitalisation

Technology, particularly artificial intelligence (AI), offers Europe its best chance to leap ahead. Yet, a cautious mindset and regulatory hesitations threaten to leave Europe on the sidelines of the next industrial revolution. The evidence is there: AI can cut costs, accelerate product development, improve sustainability and create better workplaces. Yet action must replace endless pilots and cautious whitepapers.

Europe cannot afford to wait for perfect conditions – it must build leadership through experimentation, scale and courage.

Raya White, CEO and Founder at SPATIALx

That leadership will require more than isolated success stories – it needs systemic support. Organisations like EIT Manufacturing are helping industry-wide AI integration and the development of a skills base by providing targeted funding and support.

We need coordinated, continental action, linking AI implementation with resource strategy, education and industrial investment.

Caroline Viarouge, CEO of EIT Manufacturing

The automotive sector

Perhaps nowhere is Europe’s industrial crossroads clearer than in the automotive industry. Employing 13 million Europeans and representing 7% of the EU’s GDP, the sector sits at the centre of technological, environmental and geopolitical shifts. The transition to electric vehicles, competition from Chinese brands, supply chain vulnerabilities and the race for critical raw materials – all demand urgent reinvention.

“The pace of technology is outstripping the pace of upskilling”

Speakers from Volvo Group, Ford, SKF, Mercedes-Benz and STILFOLD presented a vision of an industry embracing collaboration, circularity and innovation. As Lina Moritz, Senior Leader Public Partnerships at Volvo Group, explained: “We often describe the transformation to zero emission vehicles using an equation. If any of the five key factors – product, cost, infrastructure, green energy or value chain – is missing, the whole equation fails.”

The pace of technology is outstripping the pace of upskilling. Jonas Nyvang’s STILFOLD innovation, which is tool-less origami-inspired manufacturing, offered a glimpse of Europe’s new competitive model: combining design, engineering ingenuity and sustainability to outpace rivals not on volume, but on value. However, the sector’s success depends equally on human capital.

“In order to keep up with the pace of technological development, up-skilling and re-skilling are very important,” warned Burak Yelken, Manufacturing R&D Leader at Ford. Without massive, proactive investment in workforce reskilling, the auto sector risks being slowed by talent shortages at a time when it must sprint.

Jonas Nyvang, Lina Moritz, Karin Helmstaedt, Burak Yelken, Okan Otuz, Magnus Wahlgard (SKF) at InnoHive 2025. Photo credit (c) Xavier Lejeune

Europe’s future

Across all sessions focused on Europe’s competitive edge, one truth emerged: Europe has the ideas, the people and the technological capacity to lead, but it needs to move faster, think bigger and act together. This future won’t be delivered by waiting for perfect conditions or ideal global markets. It will come by embracing the assets Europe already possesses – deep industrial expertise, innovative SMEs, commitment to sustainability – and connecting them with the speed, unity and ambition the times demand.